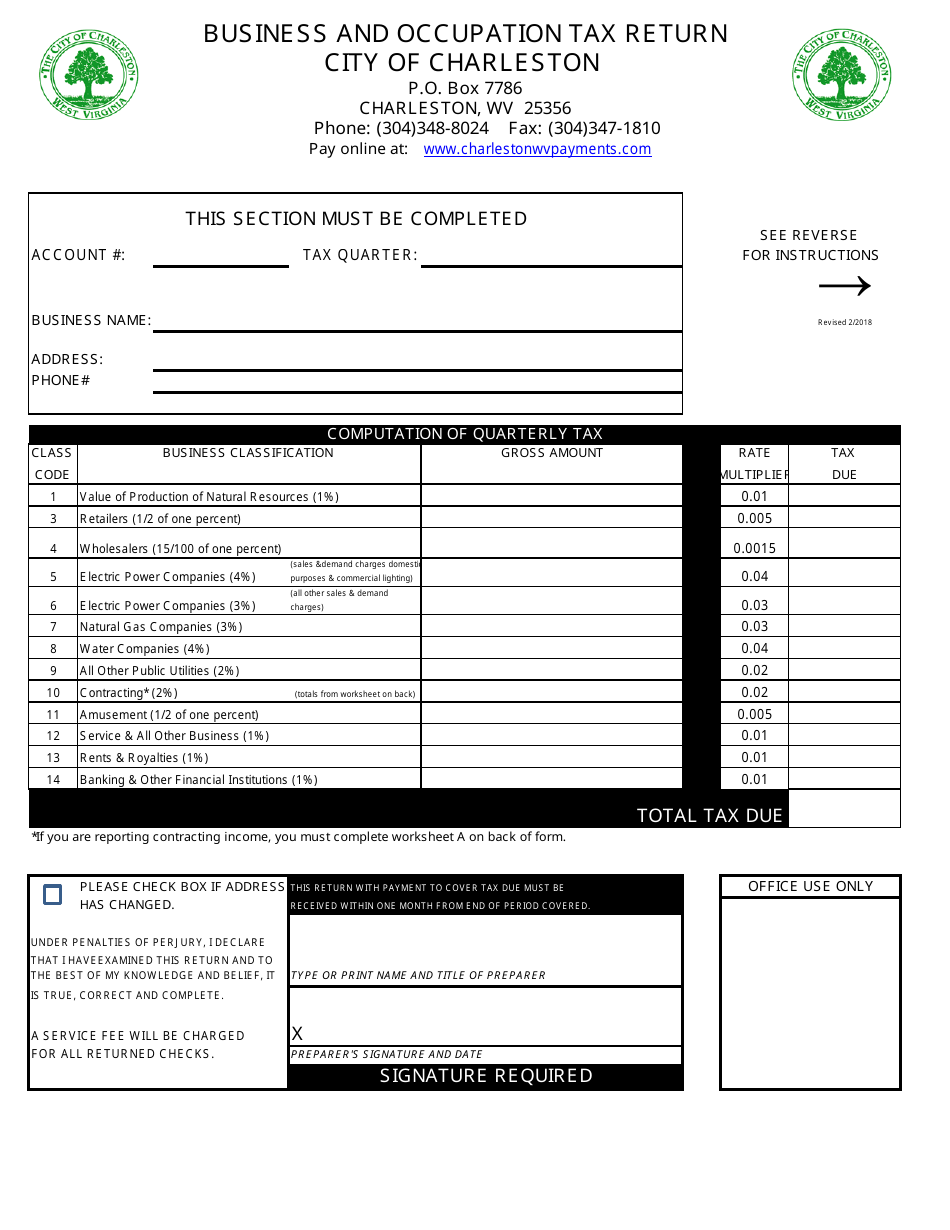

b&o tax form

That is the tax is measured on the value of products gross proceeds of sales or gross income of the business in the City. PO Box 2514 Beckley WV 25802Physical Address.

The Seattle business license tax is not the same as the Washington state BO tax.

. 29 of the tax due if not received on or before the last day of the second month following the due date. Minimum penalty on all late returns where tax is due is 500. You must file your Seattle taxes separately from your state taxes.

Requirements for the BO tax credit. Contracting class instructions are listed below 3. Please file your City BO taxes on the FileLocal portal.

The amount due is based on the businesses gross income less certain deductions for that period. Please write this department if you have questions concerning completing this form or concerning your taxability. Businesses may be assigned a quarterly or annual reporting period depending on the tax amount or type of tax.

The Citys B. Address your inquiries to City of Longview B O Tax Department 1525 Broadway PO Box 128 Longview WA 98632. Handy tips for filling out Tax lacey form online.

The tax amount is based on the value of the manufactured products or by-products. An account will need to be created with Localgov prior to proceeding. Complete and return the appropriate form below based on your businesss annual total gross revenue.

There is no penalty on late returns with no tax due. States of Washington West Virginia and as of 2010 Ohio and by municipal governments in West Virginia and Kentucky. Utility Tax Rules are located at 342040.

If you have any questions please contact a Revenue Service Representative at 304 696-5540 option 4 or email financehuntingtonwvgov. Note Utility Taxes are Exempt from the following Rules YMC 504040. BO Tax Returns must be filed quarterly.

Bring your return to the Finance Department located on the first floor of City Hall 210 Lottie Street Bellingham WA. Unused credit may be carried forward to future reporting periods for a maximum of one year 12 months from the end of the tax reporting period when the credit was earned. Richmond BO Tax Clerk Contact InformationMailing Address.

Determine you Charleston BO taxable gross income for each of the classifications and enter it in the appropriate box. However you may be entitled to the. To learn more about the state BO tax visit the Washington State.

Business and Occupation BO tax is collected either quarterly or annually. CONTACT THE CITY OF WHEELING AT 304-234-3653 FOR ADDITIONAL INFORMATION. Syrup must be used by the buyer in making carbonated drinks sold by the buyer.

Please include your customer number. To submit your B O Tax Form follow these instructions. Note that GROSS INCOME GREATER than 5000 for this reporting period OR 20000 for an annual reporting period shall be taxed at the rates below.

BO TAX Finance Department 409 S Kanawha St Beckley WV 25801 Finance Department Departments Heather A. All businesses conducting transactions in Lacey whether or not the business is physically located within the city must be registered with the City of Lacey. If you need to file a 2021 annual tax return and have revenue that is below the 100000 threshold you can use this tax form.

Note GROSS INCOME LESS than 5000 for this reporting period or 20000 for an annual reporting period do not owe. You may also reach us at 3604425040. Box 1659 Huntington WV 25717.

Determine your Business Classifications and corresponding rates from the tax table. BO Tax Return Form Rental Property Registration Form For Additional Details. Filing periods end on March 31 June 30 September 30 and December 31 unless other arrangements and permission has been granted by the Finance Division.

The business and occupation tax is a type of tax levied by the US. Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller However people or businesses that engage in business in Washington are subject to business and occupation BO andor public utility tax. Complete the BO Tax Form and mail your payment check or money order made out to the Finance Director to.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Lacey was b o tax form online design them and quickly share them without jumping tabs. B O Tax Return City of Huntington PO. 800 Fifth Ave Huntington WV 25701 Room 20.

General BO Tax Information. Determine your taxes due by multiplying the rate by the taxable income. See Codified Ordinances of the City of Wheeling Part 7 Chapter 5 Article 787 BO TAX CLASSIFICATIONS AND RATES VARY ACCORDING TO THE TYPE OF BUSINESS.

If you would like assistance navigating the FileLocal system please call FileLocal directly at. If this Tax Return is past due the following penalties must be included in your payment - minimum penalty. All returns are due 30 days after the end of the applicable filing period.

It is a type of gross receipts tax because it is levied on gross income rather than net income. If your business grosses 250000 in Bremerton during 2019 you would list 250000 as your gross revenue then deduct the allowed exemption of 200000 from the gross. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

If no reportable activity 000 gross sales occurred during the filing period indicate. If you are unable to file or renew using the FileLocal portal then you can print and mail the tax return. Once your business is licensed with the State you will automatically receive either a quarterly business and occupation tax form or an annual business and occupation tax form by mail from the City of Issaquah near the end of each reporting period.

Simplified income payroll sales and use tax information for you and your business. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing BO Tax and the Wholesaling or Retailing BO Tax. Being a gross receipts tax means there are no deductions for labor materials or other costs of doing business.

City of Bellingham Finance Director 210 Lottie Street Bellingham WA 98225 In Person. Credit must be claimed in the tax reporting period when the syrup was purchased. File and pay BO taxes.

RETURN COMPLETED TAX RETURN TO ABOVE ADDRESS AND MAKE CHECK PAYABLE TO. While deductions are not permitted for labor materials or other overhead expenses the State of. Printing and scanning is no longer the best way to manage documents.

BO Taxes can be paid online at Localgov. 409 S Kanawha StreetPhone.

Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller

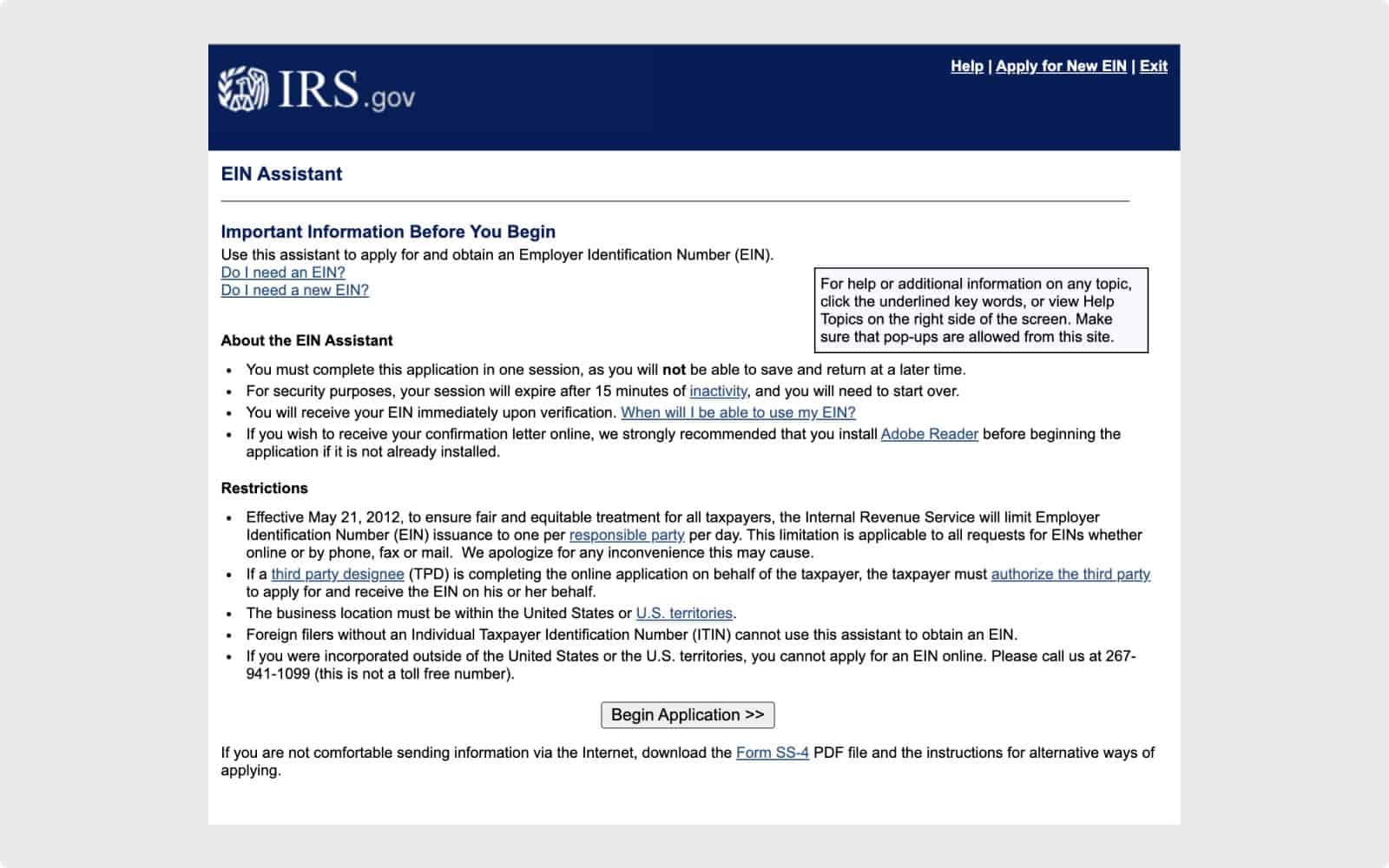

How To Get A Tax Id Number For An Llc Quick Guide Simplifyllc

Wa Business Occupation Tax Return Tumwater Fill Out Tax Template Online Us Legal Forms

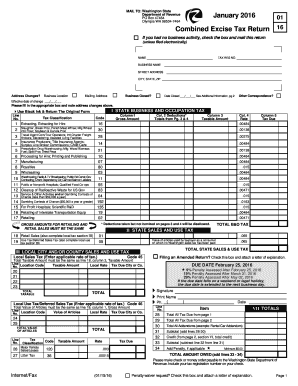

Record Wa Dor Excise And Sales Tax Payment In Quickbooks Online Gentle Frog Bookkeeping And Custom Training

City Of Olympia B O Tax Form Fill Online Printable Fillable Blank Pdffiller

Wei Combined Excise Tax Return Form Fill Out And Sign Printable Pdf Template Signnow

50 First B O Passenger Diesel Painted For Abraham Lincoln Service On Subsidiary Chicago Alton Baltimore And Ohio Railroad Alton Train

Tax Filing Example Washington Department Of Revenue

Tacoma B O Tax Fill Online Printable Fillable Blank Pdffiller

West Virginia Business And Occupation Tax Return Form Download Printable Pdf Templateroller

B Amp O Tax Return City Of Bellevue

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Tacoma B O Tax Fill Online Printable Fillable Blank Pdffiller